Large Corporations Must Follow Which Basis of Accounting

You also cant use cash-basis. A corporation is an entity recognized by law as possessing an existence separate and distinct from its owners.

International Financial Reporting Standards IFRS Accounting Standards for Private Enterprises ASPE.

. Large corporations must follow the _____ basis of accounting. The accrual basis of accounting is used to calculate revenues and expenses. When a corporation changes accounting methods adjustments must be made to ensure that the change does not result in the omission or duplication of income or expense Sec.

1 A qualified personal services corporation is a corporation i substantially all of the activities of which involve the performance of services in the fields of health law engineering architecture accounting actuarial science performing arts or consulting. Inventory accounts must be charged with the actual cost of goods purchased or produced and credited with the value of goods used transferred or sold. Large corporations must follow the.

The following taxpayers may use the cash method Text of Revenue Procedure 2002-28 and Examples. C corporations with average annual gross receipts of 5 million or less for the three previous years. Auditing of Financial Statements.

Accrual Basis of Accounting. Accrual basis accounting is the standard approach to recording transactions for all larger businesses. This is the easiest approach to recording transactions and is widely used by smaller businesses.

By independent certified public accountants. Accrual accounting is an accounting method where revenue or expenses are recorded when a transaction occurs versus when payment is received or made. In the US it has been established by the Financial Accounting Standards Board FASB and the American Institute of Certified Public Accountants AICPA.

Endowed with many of the rights and obligations possessed by a person a corporation can enter into contracts in its own name. Multiple Choice A corporation can choose the fiscal year-end of its choice when it files its first tax return without approval of the IRS A corporation with average annual gross receipts of 10 million must use the accrual basis of accounting. Partnerships with a C corporation as a partner with 5 million or less in average annual gross receipts for the three previous years.

C corporations other than farms must use the accrual method if they have average annual gross receipts for the previous three tax years of more than 5 million IRC section 448b3. Generally accounts must include. There are two accounting methods practiced by companies.

Cash basis of accounting has low accuracy. Accrual Corporations whose stock is publicly traded must have their financial statements __________ by. With cash-basis accounting you do not record expenses that you will pay in the future but have not yet paid.

The IRS restricts some businesses from using the cash-basis method. Corporations choose their tax year in their first year of operation and can elect to change it in their third year of operation. If you dont meet any of the criteria listed under the When you can use cash-basis accounting section you cant use the cash-basis method.

Accrual basis of accounting is more accurate than the cash basis of accounting. In this chapter we will describe and illustrate how to account for transactions using the accrual basis of accounting. Cash basis of accounting is suitable.

Which of the following is true regarding the government-wide Statement of Activities. Under the accrual basis of accounting a business recognizes revenue when. And sue and be.

31 Contents of your companys accounts. More Cash Flow From Operating Activities CFO. Accrual Basis vs.

A calendar year corporation must file its tax return no later than March 15 unless it requests an extension. The Generally Accepted Accounting Principles GAAP are a set of rules guidelines and principles companies of all sizes and across industries in the US. This concept differs from the cash basis of accounting under which revenues are recorded when cash is received and expenses are recorded when cash is paid.

Under cash basis of accounting financial statements cannot be audited. Both of the above. Under the cash basis of accounting a business recognizes revenue when cash is received and expenses when bills are paid.

The accrual accounting method and the cash accounting method. A profit and loss account or income and expenditure account if the company is not trading for profit a. Only the accrual accounting method is allowed by generally accepted.

Hire and fire employees. Large corporations without inventory can choose to use either the cash or accrual method of accounting. You can figure the cost of goods on hand by either a perpetual or book inventory if inventory is kept by following sound accounting practices.

Cash Basis of Accounting. Under accrual accounting revenues are recorded when they. These three options are.

Multiple Choice Program revenues include charges for services operating grants and contracts capital grants and contracts and taxes levied for specific purposes. March 28 2019. The accrual method is also required for tax shelters IRC section 448a3 and for general partnerships failing the 5 million test that have a C corporation as a partner section 448a2.

Corporations whose stock is publicly traded must have their financial statements. Financial statements can be audited only when they are prepared using accrual basis of accounting. In Canada for-profit businesses have three main options to choose from when selecting the accounting standards or basis of accounting on which they will base their financial statements.

481a adjustments can increase income a positive adjustment or decrease income a negative adjustment Regs. And ii substantially all of the stock by value is held directly or. Credits must be determined on the basis of the actual cost of goods.

That is it is a separate legal entity. A calendar year corporation must file its tax return no later than March 15 of the following year C corporations must annually file a Form 1120 tax. Buy sell or hold property.

Large corporations such as AOL-Time Warner must follow generally accepted accounting principles that re-quire the use of the accrual basis of accounting.

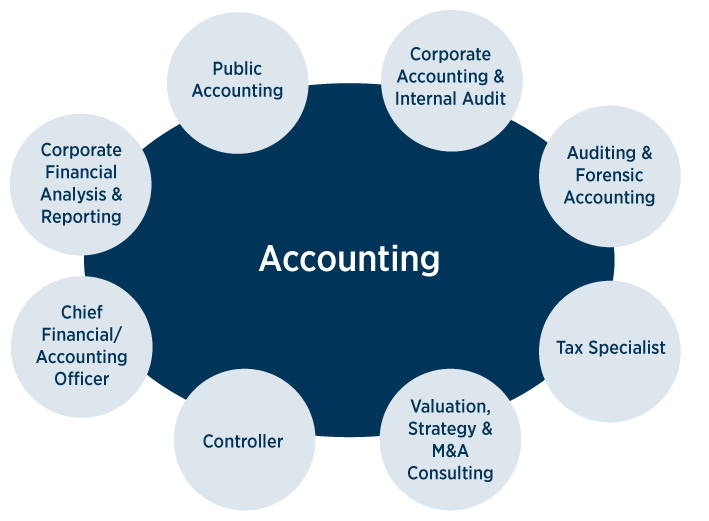

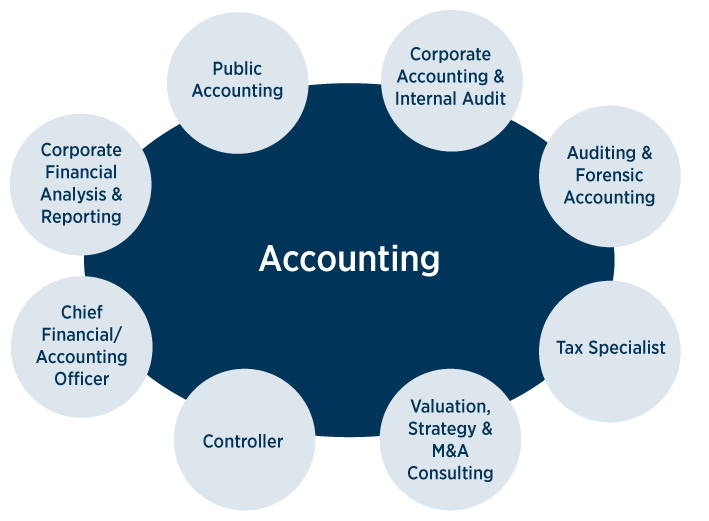

Master S In Accounting Undergraduate Accounting Certificate Edwards Campus

/corporate-accounting-1cad2316063e44df85f2928eb42dfd16.jpg)

Comments

Post a Comment